Welcome Chip Cards

They are harder to counterfeit because they send a code to authorize each purchase, instead of sending ALL of your financial information, as the magnetic strip cards do. Each time you use the card, a new code is generated for that sale; no codes are ever the same. This only works when you use a ‘chip reader’ terminal. Retailers that had security breaches in the past were liable because magnetic strip information was recorded through their point of sale system. The new technology helps to reduce the risk to the retailer and the consumer.

Additionally, the new chip reader terminals require the card to be placed into the machine and remain in the machine while you make a purchase. This process requires you to enter a pin number or sign your name for validation. If the card is removed during the purchase, the purchase is not authorized.

Once you receive your new card, you will have received one of two types. If you’re required to enter your pin number at the point of sale, you have received a ‘chip and pin’ card. If a signature is required with no pin, you have received a ‘chip and signature’ card.

Note: All of the new cards will still have the magnetic strip. If you choose to ‘swipe the strip’, the merchant will not be liable for fraud on the card. The only way the merchant is held responsible with the new chip cards is if the chip technology was used in the chip reader for that fraudulent purchase. If your card has been lost or stolen, report it immediately.

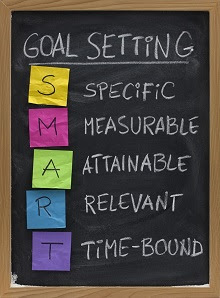

Goal Setting Makes For Better Performance

Goal setting has become a part of business too. Businesses have yearly performance reviews and ‘goal setting’ for future performance as a company and for you as an individual. When we set goals for ourselves and work toward them, we have better performance and the chance to achieve our goals. When we don’t, we miss out on salary increases or can lose our job.

The same thing holds true for your financial future. We can’t guarantee the performance of your investments, but setting goals and working toward them, along with planning, saving, and monitoring your investments makes for a greater chance of success. I look forward to helping you reach your financial goals.

Sustainable Investing? What Is It?

‘Sustainable’ has to do with companies represented in the fund or investment continuing to exist. Even though they are considered to be ‘socially responsible’, do these companies put themselves at risk to environmental or social problems that could cause lawsuits, public issues, or harm or death of life? These factors can cause investors to liquidate the investment, leaving the market value of the investment to suddenly decline.

If you are considering an investment that is considered socially responsible, I can assist you in researching if it has a high sustainability rating. In order to make an informed decision, consider sustainability in addition to the ‘do-good’ feel of the investment.

Cash Down The Drain

Electricity Costs. Do you turn off lights and electrical items after leaving the room? Awareness of your energy consumption can save you $10-$15 per month.

Name Brand Items. We all like to look our best and use well known products. Examining your spending in the areas of clothing and beauty products and looking for alternative items can save you money. Check out the ingredients label comparing a generic brand to a ‘well marketed brand’ and make your decision based on that verses advertising. The same philosophy holds true in clothing. Check for quality in a less known brand.

The Grocery Store Splurge. Don’t go shopping hungry and bring a list. By going on a full stomach and with a list you will be more focused and not get side tracked in purchasing extra items.

Transportation Costs. These are everything from car insurance to maintenance, and gas. Some of these items are fixed, others are not and all can change depending on circumstances. It’s better to maintain a car than to let things go and end up with a bigger bill. Insurance rates should be examined bi-annually through your agent, or shop rates yourself. Changes that occur in your life can change your rates; for example paying off your car loan and no longer needing full replacement coverage.

So what does having your cash go down the drain have to do with your financial future? It has to do with you being aware of your spending habits in order to have more to save. If you are trying to track your habits and aren’t having success, meeting with me for an overall ‘spending and saving’ plan may help you.