The average household with credit card debt had a balance of $7,149 in 2020. For the average household carrying credit card debt as of September 2020, this equates to an annual interest of $1,155. With the average credit card annual percentage rate sitting at 16.43%, it represents an expensive...

The real rate of return is an important personal finance concept to understand. It’s the rate of return on your investments after inflation. The real rate of return indicates whether you are gaining or losing purchasing power with your money. So if inflation checks in at a rate of...

Why sell shares when you can gift them? If you have appreciated stocks in your portfolio, you might want to consider donating those shares to charity rather than selling them. Donating appreciated securities to a tax-qualified charity may allow you to manage your taxes and benefit the charity. If...

Mobile applications have become ubiquitous. While many of these apps are games and social media platforms, an increasing number have been developed to help individuals with their personal finances. Which leads to an interesting question: what should you look for in a personal finance app? Category One of the...

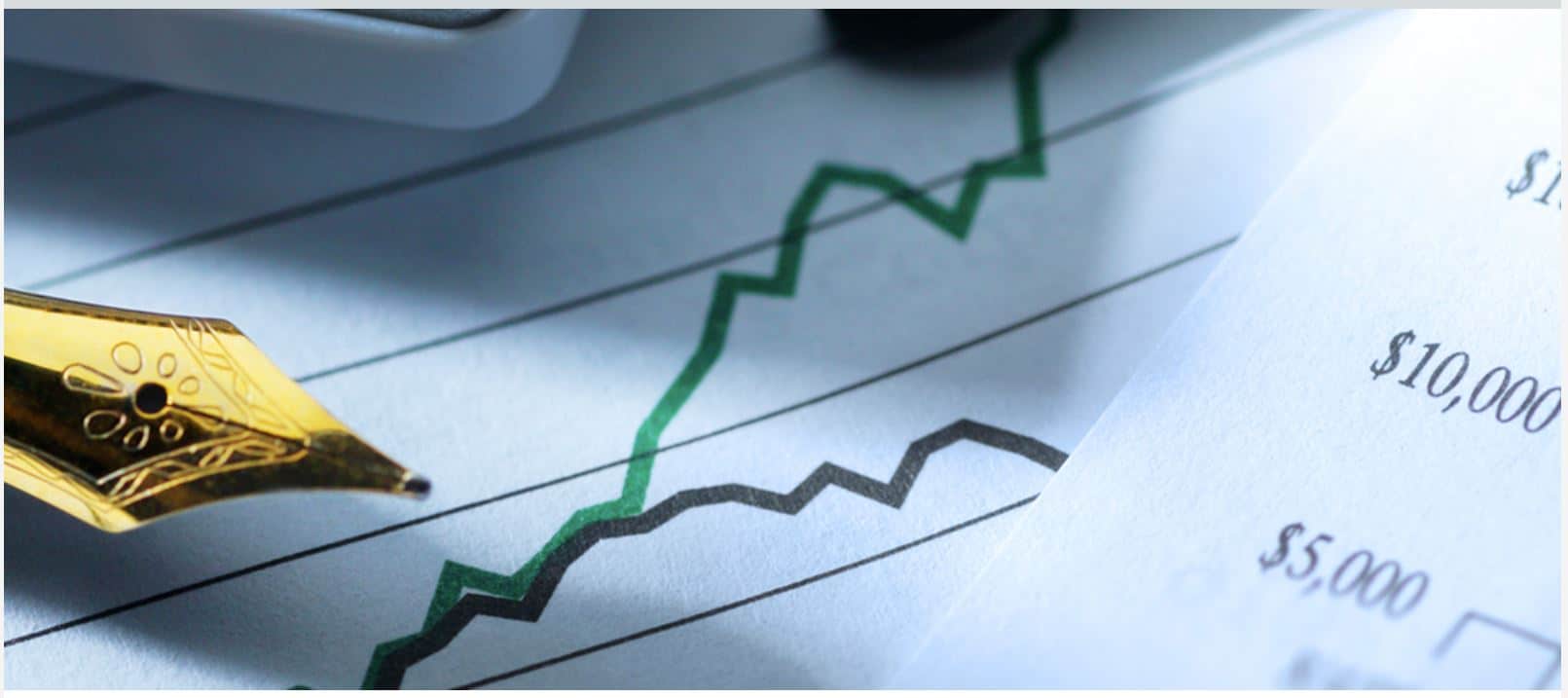

The growth of exchange-traded funds (ETFs) has been explosive. In 2002, there were only 102; by 2020, there were over 7,000 investing in a wide range of stocks, bonds, and other securities and instruments.1 At first glance, ETFs have a lot in common with mutual funds. Both offer shares...

You may have heard of the Free Application for Federal Student Aid, or FAFSA, if you or someone you know has plans to attend a college, career school, or university. Last year, over 60% of high school seniors submitted a FAFSA to the Department of Education to secure financial...

What exactly is the “sequence of returns”? The phrase describes the yearly variation in an investment portfolio’s rate of return. But what kind of impact do these deviations from the average return have on a portfolio’s final value? Let’s take a closer look at a few different investment scenarios. The...

Information vs. instinct. When it comes to investing, many people believe they have a “knack” for choosing good investments. But what exactly is that “knack” based on? The fact is, the choices we make with our assets can be strongly influenced by factors, many of them emotional, that we may...

When you read about money matters, you may see the phrase, “getting your financial house in order.” What exactly does that mean? To some, when your financial “house is in order,” it means it is built on a solid foundation. It means that you have the “pillars” in place that...

When you marry or simply share a household with someone, your life changes—and your approach to managing your money may change as well. The good news is it’s usually not so difficult. At some point, you will have to ask yourselves some money questions—questions that pertain not only to...