Are you missing the tax-free bucket?

You may plan to use a mix of assets to meet your retirement income needs but there are other more tax-efficient sources of supplemental retirement income that are often overlooked.

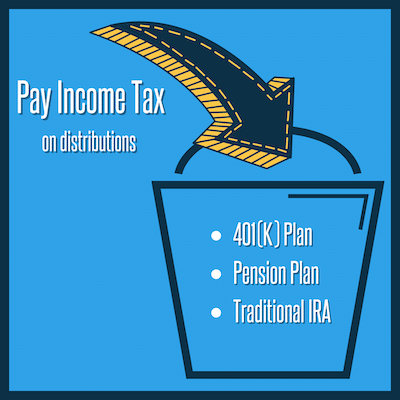

Assets Where You Pay Income Tax on Distributions

- 401(K) Plan

- Pension Plan

- Traditional IRA

Assets are usually held within a retirement plan where distributions are normally taxed at the Ordinary Income Tax Rate (max rate = 37%).

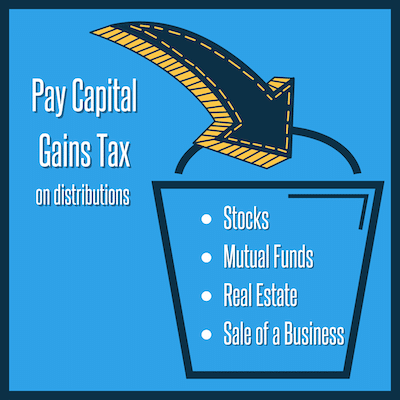

Assets Where You Pay Capital Gains Tax on Distributions

- Stocks

- Mutual Funds

- Real Estate

- Sale of a Business

Assets are usually held outside a retirement plan where earnings are normally taxed at the Capital Gains tax rate (max rate = 20%).

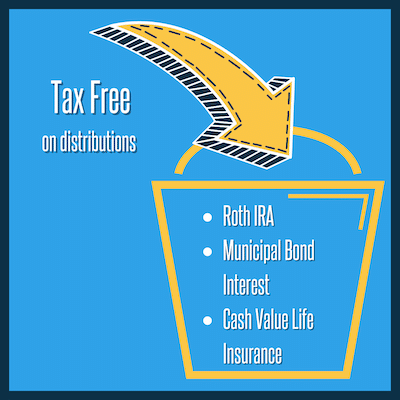

Assets That Are Tax-Free On Distributions

- Roth IRA

- Municipal Bond Interest

- Cash Value Life Insurance (when structured specifically)

Distributions are typically income tax-free.

Save More on Taxes And Accelerate Your Retirement Savings

Strategy In Action

A hypothetical case study

Meet Jack B. and Jill S. Both were small business owners in Las Vegas, Nevada for 25 years. Each of them accumulated $2.5 million dollars upon retirement and began to collect $100,000 from their retirement accounts every year. However, Jack and Jill allocated their investments into different tax “buckets”.

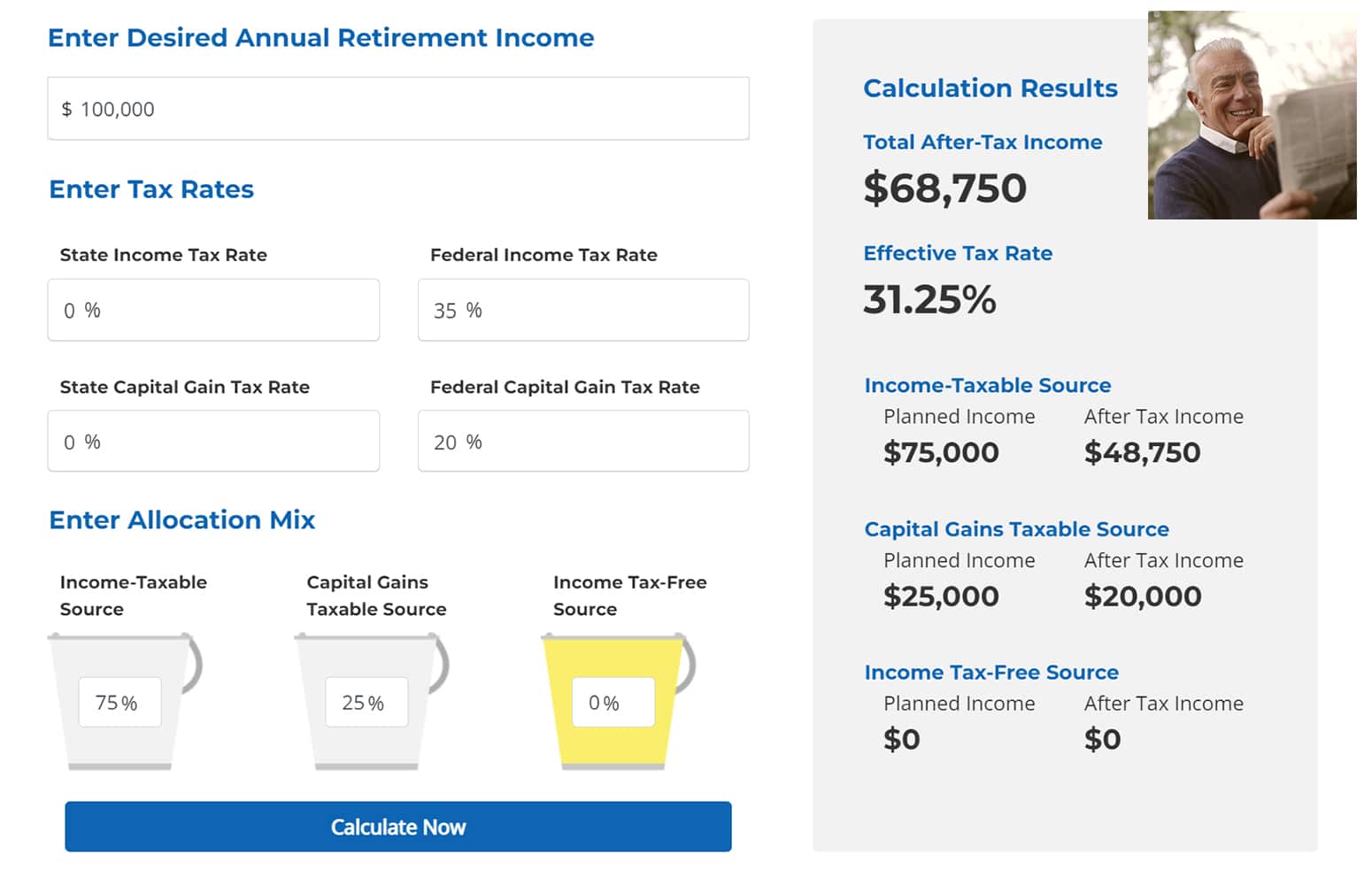

Jack decided to use the more traditional route by allocating 75% of his retirement money into his 401k at work and 25% of his money into real estate and stocks.

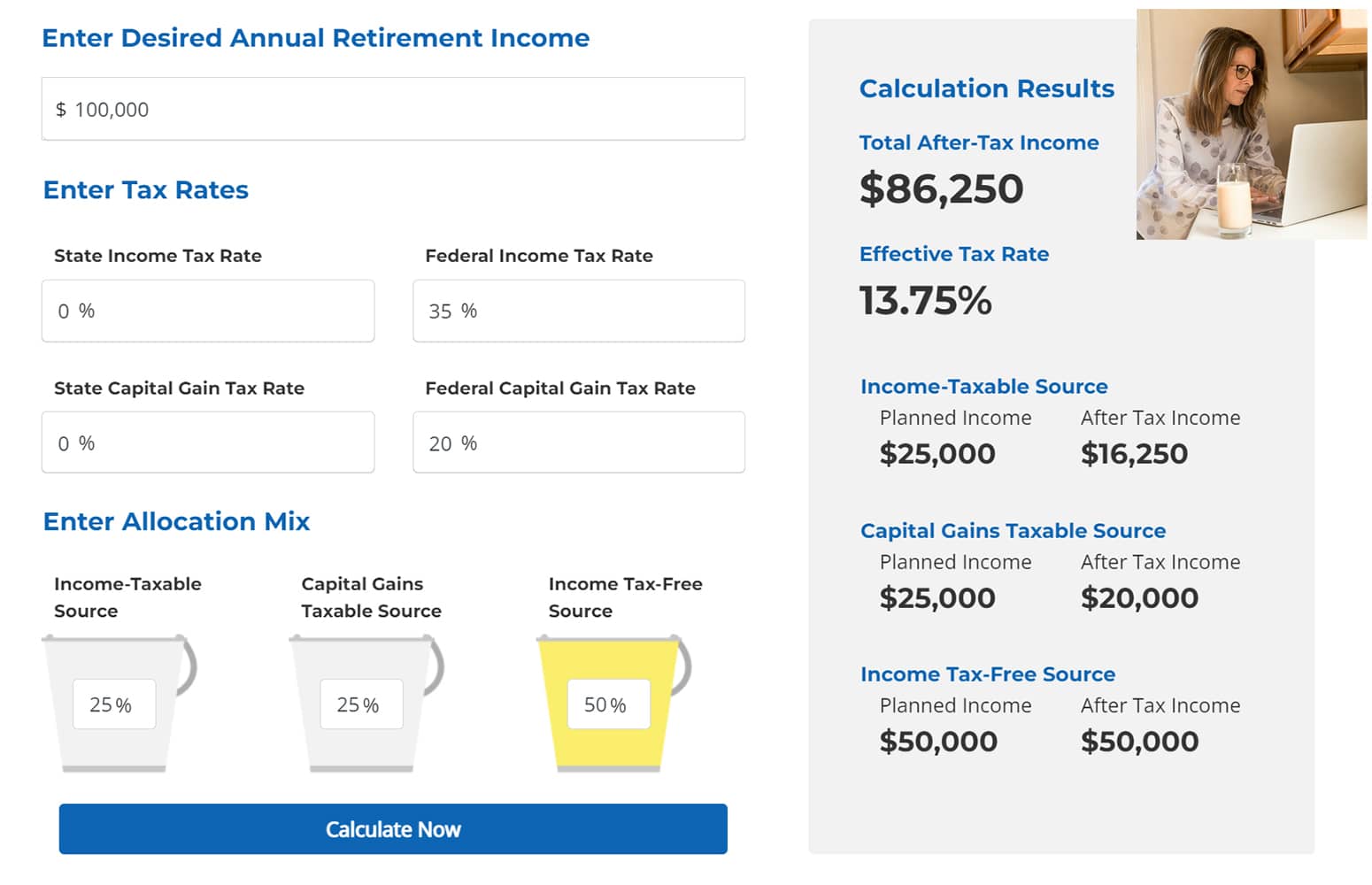

Jill on the other hand, decided to allocate 25% of her retirement money into her 401k, 25% into real estate and stocks, and 50% into a tax-free asset.

Although Jack and Jill each accumulated $2.5 million at retirement age, their retirement income became significantly different.

Jack’s effective tax rate was an astounding 31.25% which caused his $100k retirement income to be dwindled down to $68,750.

Jill’s effective tax rate was only 13.75% which allowed her take home $86,250 of her $100k retirement income! By simply allocating 50% of retirement funds into a tax-free asset, Jill was able to receive $17,500 more in retirement income!

The moral of the story? It pays to pay attention to which “buckets” you are funding during your working years.

Is your retirement portfolio tax-diversified?

See how we can help you bring the tax-smart strategy to life in your portfolio.

Schedule a discovery call today and receive a personalized illustration that is tailored toward your financial future.