7 Ideas for Celebrating Financial Literacy Month

April is recognized as Financial Literacy Month, aiming to promote financial education and awareness among individuals. Reflecting on one’s financial habits and learning ways to improve them is crucial. In today’s world, where financial stability is vital, celebrating Financial Literacy Month is more important than ever. Here are some ways to celebrate and enhance your […]

Earth Day: A Focus on Sustainable and Ethical Investing

Earth Day is observed annually on April 22nd, raising awareness and inspiring actions toward preserving the environment. While this day typically focuses on reducing plastic waste and conserving energy, it is also an opportune time to discuss sustainable and ethical investing. Sustainable and ethical investing, or socially responsible investing (SRI), refers to investing in companies […]

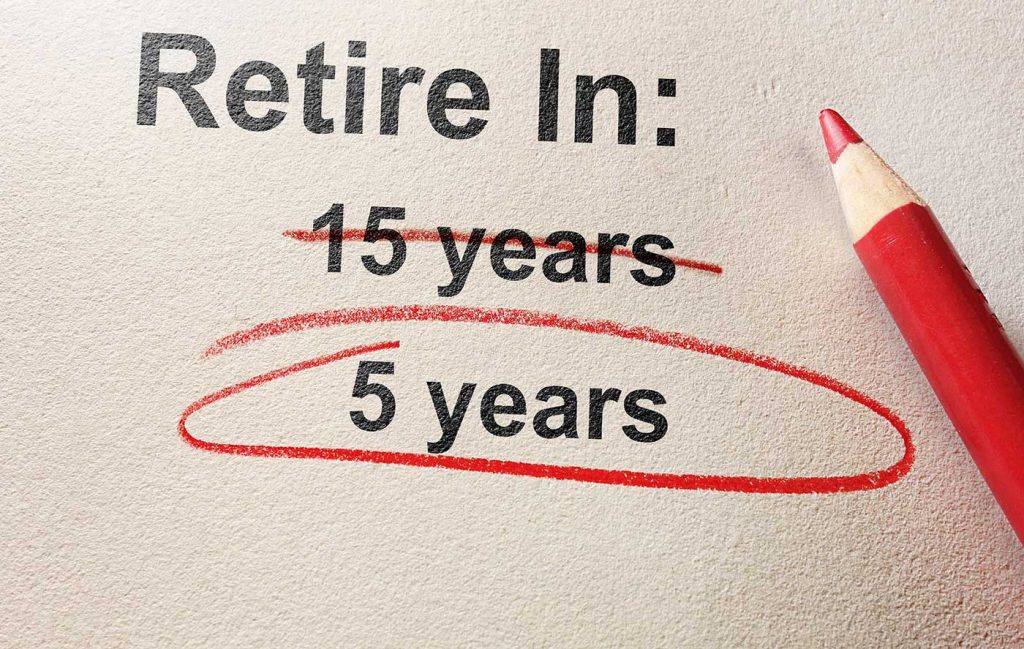

7 Steps to Help You Plan for Retirement

Wealth preservation is essential for many individuals but warrants a specific focus for those nearing retirement. Understanding the complexities of wealth preservation is crucial, particularly for pre-retirees. Today’s pre-retirees may need a more detailed retirement plan, whether due to inheritance, accomplishment in the corporate world, or entrepreneurial fulfillment. Regardless of how one acquires […]

2024 Tax Season Updates and Tips

Filing your taxes can be simple when you’re prepared and understand recent changes in tax laws to determine which tax credits and deductions you’re eligible to take. The end of the 2024 tax season for most Americans is April 15, 2024, so if you still need to file 2023 taxes, take notice of these credits […]

Understanding the 2024 Social Security Changes: A Comprehensive Review

As the landscape of our economy shifts and evolves, so do the policies and practices that guide our federal programs. One such program that undergoes continual alterations and modifications is Social Security. In this article, we will explore the social security changes anticipated in 2024 that could significantly affect Americans who rely on this vital […]

5 Simple Ways to Improve Your Finances in the New Year

The onset of a New Year often brings a spirit of change and improvement. One area of life that often receives excessive attention in the New Year is our finances. Whether it is saving more, reducing debt, or managing retirement savings, financial goals usually take precedence. There are several strategies to consider for improving your […]

Comprehensive Ways to Navigate Your Retirement Savings

Navigating your retirement savings can be a challenging process due to the inherent complexities and the multitude of factors that tend to affect the most confident plan. However, a comprehensive approach can drastically increase the likelihood of yielding suitable results. Here are some tips to help you navigate your retirement savings as you work toward […]

6 Reasons Why You Should Have a Personal Budget Calendar

Many people are familiar with budgeting, providing a roadmap for spending habits. While there are many ways to budget, one standout tool is the personal budget calendar, which helps track your income and expenses spread over days, weeks, and months. Personal budget calendars help you plan and control spending, resulting in financial confidence. Here are […]

Fall: The Season for Financial Awareness

The primary goal of financial awareness is to establish and maintain healthy financial habits. Financial awareness aims to help people understand things such as budgeting, setting financial goals, making informed investment decisions, interest rates, managing debt, and saving and planning for retirement. Fall is a great time to take proactive steps toward learning and understanding […]

Sequence of Returns Risk: Impacting Your Retirement Portfolio

The sequence of returns impacts investors when they are either adding to or withdrawing money from their investments, which can create risk depending on the sequence and the market conditions at the time. If an investor is not doing either, the there is no sequence of returns risk. However, if an investor is drawing down […]

Using Life Insurance to Create Intergenerational Wealth

Have you ever wondered how some families maintain their wealth over several generations? What’s their secret sauce? The answer may lie in using life insurance to establish a legacy that lasts over multiple generations. Determining if life insurance as an intergenerational wealth-building strategy is suitable for your family is the first step. Here are some […]

A Guide to Managing Your Finances with Accountability

For some people, managing money may feel like walking on a tightrope, juggling endless expenses. But with accountability, you can turn managing money into a positive endeavor. Accountability in finance refers to being responsible enough to track, manage and optimize your spending and savings. Here are some ideas to get started managing your finances with […]

How Debt Holds Families Back from Financial Confidence

Debt can hinder financial confidence when you spend more than you make and borrow using credit. Other financial problems may occur, such as inadequate emergency or retirement savings. Another problem debt may create is what’s referred to as a debt trap, where an individual borrows money and cannot pay it back, leading to a cycle […]

10 Actions That Help You Pursue Financial Wellness

Establishing financial wellness is a personal, ever-changing state of being that enables one to exercise choice while feeling in control of finances. The individual determines financial wellness, which often includes working toward financial goals by completing specific actions. Some actions are time-sensitive, but others can occur anytime throughout the year. Here are ten actions that […]

Separating the Signal From the Noise

What kind of role can a financial professional play for an investor? The answer: an important one. While the value of such a relationship is hard to quantify, the intangible benefits may be long-lasting. There are certain investors who turn to a financial professional with one goal in mind: the “alpha” objective of beating the […]

Retirement Seen Through Your Eyes

RETIREMENTREAD TIME: 4 MIN How do you picture your future? Some see retirement as a time to start a new career. Others see it as a time to travel. Still others plan to spend more time with family and friends. With that in mind, here are some things to consider. What do you absolutely need to […]

3 Estate Challenges for Blended Families

Preparing your estate can be complicated, and if you’re a part of a blended family, estate decisions can be even more complex and nuanced. Blended families take on many forms, but typically consist of couples with children from previous relationships. Here are a few case studies to help illustrate some of the challenges. Case Study […]

Five Most Overlooked Tax Deductions

Who among us wants to pay the IRS more taxes than we have to? While few may raise their hands, Americans regularly overpay because they fail to take tax deductions for which they are eligible. Let’s take a quick look at the five most overlooked opportunities to manage your tax bill. Reinvested Dividends: When your mutual […]

Changing Unhealthy Behaviors

Most Americans know the fundamentals of good health: exercise, proper diet, sufficient sleep, regular check-ups, and no smoking or excessive alcohol. Yet, despite this knowledge, changing existing behaviors can be difficult. Look no further than the New Year Resolution, 80% of which fail by February.1 Generally, negative motivations are inadequate to effect change. (“I need […]

Choosing a Business Structure

In March 2020, about 804,398 new businesses had been created in the preceding year.1 All individuals pursuing the dream of exercising their entrepreneurial muscles, will face the same question, “Which business structure should I adopt?” Each strategy presents its own set of pros and cons. To complicate matters a bit, the 2017 Tax Cuts and Jobs […]

Should You Borrow from Your 401(k)?

The average household with credit card debt had a balance of $7,149 in 2020. For the average household carrying credit card debt as of September 2020, this equates to an annual interest of $1,155. With the average credit card annual percentage rate sitting at 16.43%, it represents an expensive way to fund spending.1 Which leads […]

Inflation and the Real Rate of Return

The real rate of return is an important personal finance concept to understand. It’s the rate of return on your investments after inflation. The real rate of return indicates whether you are gaining or losing purchasing power with your money. So if inflation checks in at a rate of 3%, does that mean any investment […]

5 Things That Seasoned Travelers Are Doing (That You’re Not)

Traveling. Some of us travel a lot, and some of us travel a little. For some of us, traveling is a job. Nearly 63 million people are employed, worldwide, in air travel and related industries.1 There’s bound to be travel wisdom among their ranks. Let’s find out. Think About Fast-Dry Clothing Think about grabbing fast-dry clothing […]

Do Your Kids Know The Value of a Silver Spoon?

You taught them how to read and how to ride a bike, but have you taught your children how to manage money? One study households with student loan debt showed that the average amount owed was $47,671.1 And more than 20% of recipients with outstanding loans will either default or be delinquent in repaying those loans.2 […]

What If You Get Audited?

“Audit” is a word that can strike fear into the hearts of taxpayers. However, the chances of an Internal Revenue Service audit aren’t that high. Between 2010 and 2018, the IRS only audited 0.6% of all individual tax returns.¹ And being audited does not necessarily imply that the IRS suspects wrongdoing. The IRS says an […]

Life and Death of a Twenty Dollar Bill

Every year, the government prints millions of notes a day. Here’s a quick look at what goes into creating a $20 bill and what determines when a bill’s lifespan ends.1 Paper A $20 bill starts out life as part of a large sheet of paper. While most paper is made primarily from wood pulp, the […]

Making a Charitable Contribution

Why sell shares when you can gift them? If you have appreciated stocks in your portfolio, you might want to consider donating those shares to charity rather than selling them. Donating appreciated securities to a tax-qualified charity may allow you to manage your taxes and benefit the charity. If you have held the stock for […]

TIPS for Inflation

In February 2018, Jerome Powell was appointed as Chair of the Board of Governors of the Federal Reserve System. He became the 16th chair to take over the helm of the world’s most influential central bank. Among other duties, he and the Fed governors are tasked with adjusting short-term interest rates to help control inflation […]

Healthy Body, Healthy Pocketbook

Many people have a clear vision of what their ideal retirement looks like. Some desire vacation homes in tropical destinations, while others plan to spend quality time with their grandchildren and family. We know that many of these dreams will come with a price tag, but of all the activities in retirement that you’re saving […]

Should You Borrow from Your 401(k)?

The average household with credit card debt had a balance of $7,149 in 2020. For the average household carrying credit card debt as of September 2020, this equates to an annual interest of $1,155. With the average credit card annual percentage rate sitting at 16.43%, it represents an expensive way to fund spending.1 Which leads […]

The ABC’s of Auto Insurance

The questions around auto insurance center not so much on whether to have it—it’s mandated by state law, required by your lender, and serves to protect your assets—but what kind of coverage you should purchase. Types of Coverage There are several forms of coverage that a car owner may purchase, some of which are […]

What to Look for in Personal Finance Apps

Mobile applications have become ubiquitous. While many of these apps are games and social media platforms, an increasing number have been developed to help individuals with their personal finances. Which leads to an interesting question: what should you look for in a personal finance app? Category One of the first things to consider is what […]

Mutual Funds vs. ETFs

The growth of exchange-traded funds (ETFs) has been explosive. In 2002, there were only 102; by 2020, there were over 7,000 investing in a wide range of stocks, bonds, and other securities and instruments.1 At first glance, ETFs have a lot in common with mutual funds. Both offer shares in a pool of investments designed […]

Managing an Inheritance

Inheriting wealth can be a burden and a blessing. Even if you have an inclination that a family member may remember you in their last will and testament, there are many facets to the process of inheritance that you may not have considered. Here are some things you may want to keep in mind if it […]

Exploring the Federal Student Grant Program

You may have heard of the Free Application for Federal Student Aid, or FAFSA, if you or someone you know has plans to attend a college, career school, or university. Last year, over 60% of high school seniors submitted a FAFSA to the Department of Education to secure financial assistance. But what many prospective and […]

Tax Efficiency in Retirement

Will you pay higher taxes in retirement? It’s possible. But that will largely depend on how you generate income. Will it be from working? Will it be from retirement plans? And if it does come from retirement plans, it’s important to understand which types of plans will be financing your retirement. Another factor to consider is […]

The Sequence of Returns

What exactly is the “sequence of returns”? The phrase describes the yearly variation in an investment portfolio’s rate of return. But what kind of impact do these deviations from the average return have on a portfolio’s final value? Let’s take a closer look at a few different investment scenarios. The first few scenarios focus on how […]

When to Self-Insure

One reality of life is that risk is ever present. It exists in our commute to work, in our investment choices, and in our lifestyle decisions. Some risks can be transferred to an insurance company (e.g. auto or homeowners), while others we assume ourselves. When you choose to bear the financial burden of an adverse […]

Emotional vs. Strategic Decisions

Information vs. instinct. When it comes to investing, many people believe they have a “knack” for choosing good investments. But what exactly is that “knack” based on? The fact is, the choices we make with our assets can be strongly influenced by factors, many of them emotional, that we may not even be aware of. […]

Saving Early & Letting Time Work For You

As a young investor, you have a powerful ally on your side: time. When you start investing in your twenties or thirties for retirement, you can put it to work for you. The power of compounding. Many people underestimate it, so it is worth illustrating. Let’s take a look using a hypothetical 5% rate of return. How […]

Building a Solid Financial Foundation

When you read about money matters, you may see the phrase, “getting your financial house in order.” What exactly does that mean? To some, when your financial “house is in order,” it means it is built on a solid foundation. It means that you have the “pillars” in place that are designed to support your long-term […]

Managing Money as a Couple

When you marry or simply share a household with someone, your life changes—and your approach to managing your money may change as well. The good news is it’s usually not so difficult. At some point, you will have to ask yourselves some money questions—questions that pertain not only to your shared finances but also to […]

Who Is Your Trusted Contact?

Investment firms have a client service feature that may be a benefit to certain investors. They will ask you whether you would like to provide the name and information of a trusted contact.1 You do not have to supply this information, but it may offer some advantages. The request is made with your best interest in […]

How Income Taxes Work

The Internal Revenue Service estimates that taxpayers and businesses spend 8.1 billion hours a year complying with tax-filing requirements. To put this into perspective, if all this work were done by a single company, it would need about four million full-time employees and be one of the largest industries in the U.S.1 As complex as […]

Your Emergency Fund: How Much Is Enough?

Have you ever had one of those months? The water heater stops heating, the dishwasher stops washing, and your family ends up on a first-name basis with the nurse at urgent care. Then, as you’re driving to work, you see smoke coming from under your hood. Bad things happen to the best of us, and […]

Buying vs. Leasing a Car

Some people approach buying a car like they approach marriage, “‘til death do us part.” Others prefer to keep their options open, trading in every few years for the latest make and model, the most cutting-edge technology, or the highest horsepower. Whichever describes you best, we all face a similar decision when it comes to […]

All Muni Bonds Are Not Created Equal

The city of Detroit emerged from bankruptcy in 2014. Still, its previous inability to pay investors left some questioning their long-held assumption about the relative safety of municipal bonds. Without question, in the wake of Detroit’s troubles, gaining a better understanding of municipal bonds makes more sense than ever. At their most basic level, there […]

Choosing a Business Structure

In March 2020, about 804,398 new businesses had been created in the preceding year.1 All individuals pursuing the dream of exercising their entrepreneurial muscles, will face the same question, “Which business structure should I adopt?” Each strategy presents its own set of pros and cons. To complicate matters a bit, the 2017 Tax Cuts and Jobs […]

A Look at Diversification

Ancient Chinese merchants were said to have developed a unique way to manage their risk. They would divide their shipments among several different vessels. That way, if one ship were to sink or be attacked by pirates, the rest stood a good chance of getting through. Thus, the majority of the shipment could be saved. […]

Avoiding Cognitive Decline

Of those aged 65 and older, 15 to 20 percent have mild cognitive impairment. People living with mild cognitive impairment are more likely to develop Alzheimers, and almost two-thirds of people currently living with Alzheimers are women.1 There are three basic forms of cognitive decline associated with aging:2 Age-related changes in memory, which are a […]

Volunteering in Retirement

This generation got no destination to hold… We are volunteers of America” “Volunteers” by Jefferson Airplane Those of a certain age will recall these Jefferson Airplane lyrics as a call to action, though for a different period and place. Even with the passage of time and through a lifetime of changes, the desire of […]

Do You Need Financial Wellness?

Financial wellness is the ability to have a healthy financial life and feel good about your financial situation. Financial wellness doesn’t have just one meaning because it can mean something different to each person. Financial wellness is a broad term that encompasses these key areas: Taking control of your money before it controls you. Determining […]

Health, Hobbies, and a More Full-Filled Life

Having a hobby or participating in a regular activity done purely for enjoyment can provide many benefits. Among the most notable is that hobbies can lead to better health and a more full-filled life. Here are some of the benefits that come from having hobbies: Hobbies improve physical health. Hobbies do not have to […]

Women & Retirement: Modern Day Challenges

Women can experience more challenges saving for retirement than men, and unfortunately, COVID-19 has added even more challenges. According to Transamerica Center for Retirement Studies report Women and Retirement: Risks and Realities Amid COVID-19, women continue to be at risk of saving enough for retirement: 52% experienced impacts to their employment situation as a result of COVID-19. […]

GME, Reddit, Robinhood: Why Investors Should Care

One of the biggest news stories last month was the heightened trading activity and price volatility of GameStop and several other companies. These company’s stocks were targeted by participants using the social media platform Reddit. Reddit supported the social media conversations among its members, and Robinhood was the trading app of choice for buying and […]

Top 5 Mistakes Investors Make and How to Avoid Them.

Learning from our mistakes is a good thing. After all, if we learn from our mistakes, we are likely not to repeat them. Sometimes psychological or emotional factors contribute to making a mistake or knowing how to avoid it. Here are the top mistakes investors make and how to avoid them: #1- Buying only […]

Portfolio Cash: Not Just for Investing

Portfolio cash accounts are typically kept for reinvesting opportunities or other events such as Required Minimum Distributions (RMDs). Investors and their advisors often want to move cash to securities for performance in an environment where interest rates are low or effectively at 0%. There are reasons that cash accounts should always be present in an […]

Tax Planning 2021 and Beyond: New Administration, New Taxes?

With a new president and administration, now is a great time to meet with your financial professional to discuss how our new president, Joe Biden, may affect your finances, taxes, and retirement. Given the balance of the U.S. federal deficit and the federal and state spending during COVID-19, increasing taxes is essential to reducing both federal debt and […]

Social Security Retirement Benefits Change Forever Starting in 2021.

The Social Security Administration has again approved a cost-of-living adjustment (COLA) for Social Security benefits starting in January 2021. The increase of 1.3 percent will increase $20 per month for the average American worker and is calculated based on the year-over-year inflation rate. The most significant change to Social Security retirement benefits starting this year […]

Are You Ready for a New Year & New Financial Focus?

2020 has been a year unlike any during our lifetimes with the COVID-19 pandemic and a poor economy. Many have been impacted with lay-offs and job losses and realize they were unprepared financially. With the start of a New Year, are you ready to focus on ways to improve your financial life? Writing down what […]

Your Portfolio and Financial Advice Before Market Turbulence

It is human nature to seek advice when things aren’t going well or when an unforeseen event occurs. Some seek financial advice from a professional only when the stock market and their investments are experiencing turbulent times. Reactive decisions made during periods of stock market volatility often cause investors to leave their current financial professional and […]

How Financial Mindfulness Will Differ in 2021

As we enter a new year, many are hopeful that 2021 will be positively different from 2020 in health, the environment, and the economy. In the wealth management industry, we know things are already different as we see more Americans wanting to plan for their futures. Our parents and grandparents experienced The Great Depression that […]

Inflation & Your Money

“If the current annual inflation rate is only 2.3 percent,1 why do my bills seem like they’re 10 percent higher than last year?” Many of us ask ourselves that question, and it illustrates the importance of understanding how inflation is reported and how it can affect investments. What Is Inflation? Inflation is defined as an […]

IRS 2021 Retirement Account Contribution Limits Increase

2021 is a great time to focus on your retirement savings! Thanks to the power of compound interest, the more you save this upcoming year, the better off you will be later. If you are ready to make more headway on your retirement savings in 2021, keep reading to find out how much you can […]

Identity Theft, Cybersecurity, and COVID-19

The COVID-19 pandemic has shifted cybersecurity and identity theft into the spotlight for both businesses and individuals. With many people working from home, the need for internet security is at an all-time high. Businesses are experiencing more cybersecurity attacks and their remote workers are targets of phishing. As we enter December, “Identity Theft and Prevention […]

Post-Election Market Volatility: Is it Over?

With the election over, investors may be wondering about market volatility as we enter 2021. Regardless of politics, short-term stock market results can vary depending on factors, including gridlock in the House and Senate, and a newly elected future President Biden. Tracking trends like this in the stock market tends to be easier than understanding why they […]

Financial Planning to Reflect Our ‘New Normal’

COVID-19 has changed everything from our jobs to school learning and shopping and how we plan for retirement. The pandemic has created implications for financial planning on critical items, moving them front and center for those saving for retirement and those already retired: Healthcare costs. With the Affordable Care Act’s future undecided in the […]

2020: A Timeline Recap

2020 has been unlike any other thanks to the COVID-19 pandemic, our strange stock market, and social unrest leading up to the Nov. 3rd Presidential Election. This recap is for you to see what we have already been through as we look toward a brighter future as we assess what we have learned from this […]

A Strange Stock Market for Strange Times?

COVID-19 is changing the way business is conducted, resulting in economic fallout, and stock market declines in many parts of the world. However, here in the U.S., while companies are closing, the stock market remains resilient in the middle of an economic crisis. Why does Wall Street appear to be disconnected from Main Street as […]

When is the Best Time to Take Social Security Retirement Benefits?

As you get older, the question of when to collect Social Security retirement benefits will likely come to mind, particularly true if you plan to retire early. In a perfect world, there would be one age that would be ideal. However, your unique circumstances and goals will dictate the best time for you to take Social […]

How Technology Can Improve Your Financial Wellbeing in 2021

The coronavirus pandemic has motivated financial professionals to take full advantage of technology. Many of them are pairing various tech solutions with their unique human touch to help clients improve their financial well-being. So how can you, as a client, use similar technology to make a positive difference in your finances? Keep reading to find out. Automation- If […]

The Cost of Procrastination

Some of us share a common experience. You’re driving along when a police cruiser pulls up behind you with its lights flashing. You pull over, the officer gets out, and your heart drops. “Are you aware the registration on your car has expired?”You’ve experienced one of the costs of procrastination. Procrastination can cause missed deadlines, […]

Now is the Time to Schedule Your Fall Financial Review

October is the Financial planning month and a great time to meet with your financial professional to ask questions, review policy and portfolio performance, and make decisions that keep you on track with your goals. Regardless of your age, it would be best of you planned for your financial future. Reviewing your insurance policies and […]

Fall Festivities and Socializing- Safely

Socializing is critical for mental health, and people who associate with others live longer. Research also concludes that isolation can often lead to loneliness, depression, and other health problems. Especially now, during COVID-19, our desire to connect with others is heightened. Before the fall season changes to winter and cold weather arrives, get out and enjoy the […]

Health Savings Accounts: For Today and Your Retirement Years

If you are not contributing to your health savings account (HSA), you miss out on a great way to save for health care expenses now and during retirement. HSAs allow you to save money tax-free through payroll deduction. Like traditional investments, some HSAs provide fund choices to increase accumulations With health care costs continuing to grow […]

Understanding Individual 401(k) Plans

If you’re self-employed or own a small business, you’ve probably considered establishing a retirement plan. If you’ve done your homework, you likely know about simplified employee pensions (SEPs) and savings incentive match plans for employees (SIMPLE) IRA plans. These plans typically appeal to small business owners because they’re relatively straightforward and inexpensive to administer. What […]

COVID-19 and Retirement

As 2020 comes to an end, more and more Americans are contemplating their decision to retire. Others are tapping their retirement savings, while some save more due to the economic fallout and impacts of COVID-19. A recent study by TD Ameritrade, the COVID-19 and Retirement Study conducted from April 24th through May 4, 2020, reports that 41% of […]

Inflation and Taxes Could Rise. Are You Ready for Retirement?

Americans are starting to see the impact of increasing prices at the supermarket and the start of inflation. Also, clothing at retail stores is depleting as manufacturing has halted, creating demand for products ordinarily accessible. Today’s economic conditions are much worse than coming out of the Great Depression. During periods economic recovery, the U.S. experienced historical debt […]

Crisis Preparation: Safeguarding Your Financial Future

Experiencing the death of a loved one and what can financially happen if not appropriately planned for is an unfortunate reality for many. Not having protection through insurance and legal documents can turn a tragic situation into a financial crisis. Having safeguards in place provides your family with the financial security they need should the […]

2019 IRS Tax Filing & Retirement Account Contribution Extensions

COVID-19 has changed the deadline for 2019 tax filings and retirement account contributions to July 15th, 2020. The tax filing deadline change is part of the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) stimulus package for tax payors. Additionally, the closure of Social Security offices, IRS tax collection processing centers, and state governments […]

Homelife and Remote Work: The New Normal

If you are working from home and receiving a paycheck during this pandemic, consider yourself lucky despite your confinement to one place. Most of us haven’t had the experience of our personal and work lives forcibly intertwine due to a large-scale public health emergency. Remote work is not something new to our society but is […]

The CARES Act, RMD, and Hardship Distribution Changes

The CARES Act (The Coronavirus Aid, Relief, and Economic Security Act) became law on March 27th, 2020, and contains significant legislation for Required Minimum Distributions (RMD) for those over age 70 ½ who have already started RMD. Under previous IRS distribution laws, a minimum distribution from a pre-tax retirement savings account, such as a 401(k), […]

College Awards Season is Here! Now Ask for More $

Spring is the season when high school seniors and their families find out if their awards package at their chosen college or university is enough-or not. A happy time can become stressful when financial aid and award letters arrive with evident shortfalls. It doesn’t have to be that way, and most families don’t realize that […]

Reflect, Reset, Rebalance Your Life

Not everyone experiences a life-changing event in their lifetime, one that impacts them for better or worse. As we continue to experience the pandemic, we are witnesses to our own experiences. We don’t know what the outcome will be for ourselves, our neighbors, community, and so on. It can be an unnerving, but positive experience […]

Women and Retirement: Closing the Gender Pay & Retirement Savings Gap

Today’s women are more educated and have more significant job opportunities compared to previous generations. Despite more women in the workforce than ever before, women still experience considerable pay disparity compared to their male counterparts, creating a deficit in wages and retirement savings. Even though women participate in employer retirement savings plans, many still struggle […]

Coronavirus and The Markets: What You Need to Know

With coronavirus (COVID-19) all around us, investors may be wondering how their investments will fare as this ‘global pandemic’ spreads. Is COVID-19 capable of moving markets? We know it is and came at a time when the economy was already stressing. Earlier market movements starting in February 2020 were the result of unassociated economic factors […]

Insurance Services in Las Vegas

INSURANCE IS A VALUABLE TOOL EVERYONE SHOULD CONSIDER In today’s world there are many uncertainties, but without being humorous, the one certainty we can rely on is each of us has a mortality schedule and will pass away. The hope for many is that we can live a full life and live into our 80’s […]

Trust and Estate Planning Las Vegas

ABOUT TRUST AND ESTATE SERVICES IN LAS VEGAS When creating a financial plan for the future it is very important in my opinion to also plan for the unexpected. There aren’t many guarantees in life but as we all joke with the saying, the two guarantees are taxes and death! Even though this is said […]

HENRYs with Limited Wealth-Building Potential- Are You One of Them?

The term HENRY (High Earners Not Rich Yet) refers to individuals who have the potential to become wealthy in the future because of their income. These individuals or families earn between $250,000 and $500,000 per year and are between 25 and 45 years of age (Gen Z, Millennials, and Gen X). Despite their income, after […]

Financial Planning and Living Globally

The past 100 years have seen changes in how people plan for their financial futures and how they live. Borders no longer restrict people from living in one country; their profession often takes them to parts of the world they never anticipated. Today, it’s not uncommon for a family to live part-time in one country […]

Green Lending in the United States: Benefits for Sustainability and Debtors

A growing trend in global debt markets, Green Lending, continues to grow among American debt investors. Green Lending ties sustainability initiatives into loan products designed to entice and reward debtors who meet sustainability goals. The debtor’s sustainability goals are performance-based and include such things as lowering electricity and water usage, reducing landfill garbage, increasing recyclable […]

Climate Change and Finance: Are They Connected?

Over the past ten thousand years, the Earth’s climate has remained stable. Today, we know through science and research that climate change is happening. Many scientific organizations are studying the impact of climate change while simultaneously economists are examining the socioeconomic implications in various regions of the world. Climate change is undoubtedly impacting finance and […]

A Debt Reduction Plan for 2020

Being debt-free is possible for everyone, regardless of income. Learning to manage our debt and spending habits and then focus on saving can be life-changing and positively affect your net worth. Net worth calculates by subtracting your liabilities (debt owed) from your assets (not financed). Net worth is calculated for both individuals and companies and […]

Drawing Social Security Early and Still Working?

Many people decide to ‘semi-retire’ early and start taking their Social Security Retirement benefit at the earliest age possible. It’s appealing to be able to work part-time or where you have an interest or start a small business while making an income and receive Social Security retirement benefits. While early retirement and a part-time job […]

Join Our Growing Team – Looking for an Admin Assistant

Become a part of a growing, local financial advisory firm! Link Financial Advisory is a Las Vegas based firm that aims to provide exceptional service for a wide range of financial needs. As an independent firm, we are able to offer a variety of strategies, investment products, and life insurance and are not beholden to […]

The SECURE Act Is Law – Notable Changes to Retirement Savings

Effective January 1, 2020, the SECURE Act, a progressive change to retirement savings plans, is now law. The last legislation to retirement savings happened when Congress allowed for automatic enrollment of employees and the addition of Target Date funds to retirement plans in 2006. While the new law intends to provide additional opportunities for Americans […]

Countdown to Tax Season

With 2020 barely started, preparation for tax season is underway for many investors. Now in the second year of filing taxes under the Tax Cuts and Jobs Act of 2017 (TCJA), focusing your attention on deductions you can use versus those that were eliminated will necessitate that you plan. The idea of TCJA was to […]

2020 Is the Year to Be Money Savvy

Review your saving and spending habits and assess what you can do to save more this year. Definition of Savvy: having or showing perception, comprehension, or shrewdness especially in practical matters. Money Savvy: smart with money, money-wise, financially astute, shrewd. If you started saving for retirement early, chances are you’ll hit your retirement goal. However, if you’re […]

Until Debt Do Us Part

What steps can you take to help transition the obligation of debt best in a divorce situation? When saying “I do,” to any relationship, seldom is the thought of ending the relationship discussed or the division of joint debt. For couples that combine both assets and liabilities, a split signals the dilemma of dividing both. […]

Aging in Place: Growing Older at Home

If you plan to ‘age in place,’ it’s important to discuss your intention with your family and financial advisor now to prepare for and make it possible. The U.S. population continues to age, with the baby boomer generation now the largest generation ever. By 2035, one in three heads of households will be someone age […]

Your Retirement Nest Egg – A Carton Full of Options

If you have multiple or only a few retirement ‘nest eggs,’ now is an excellent time for us to discuss how taxes will impact you this year or in the future. Many people refer to their retirement savings as a “nest egg,” but in theory, it should be made up of many sources of retirement […]

Retirement Plan Contribution Limits Increase in 2020

In November 2019, the Internal Revenue Service (IRS) announced the cost of living adjustments for 2020 for most retirement savings plans. However, IRA contribution limits will stay the same. If you plan to make the maximum contributions you can in 2020, here’s what you need to know: • The limit on annual employee contributions to […]

Want to Retire in Harmony? Make Sure All Parts of Your Plan Are in Sync

A retirement plan is a lot like an orchestral score, and when all the pieces come together it can be a beautiful thing. Are you making music, or could your plan use a tuneup? Full Kiplinger Article Here Authored by our very own, Richard London CFP.

Dare to Dream: Your Success Depends on It

Dreaming and goal setting are interrelated; first, you dream about what you want, then you determine how to obtain it. Our dreams should help guide us to make the right choices at the right time and in the proper manner. But merely dreaming about something is not enough; we must set goals to achieve it. […]

10 Financial Tasks To Complete Before 2020 (Yes, You Have Time)

Here we are, already to the end of 2019! The end of a year and the start of a new one is when most people decide to clean up and implement changes in some areas of their lives. Whether it is financial or health-related, starting the New Year off with tasks completed feels good! Here […]

Understanding Fixed-Income: For Today and the Future

Fixed income is something many investors don’t understand, according to the 2019 survey, “Fixed Income, Not Fixed Thinking,” by BNY Mellon Investment Management, one of the largest asset managers in the world. The study revealed that the majority of Americans surveyed have a limited understanding of fixed-income investments, regardless of age, income, education level, and […]

Social Security 2020: Increasing Taxes, Payments, and the Full Retirement Age

Social Security Retirement benefits are set to increase in 2020- a modest 1.6% increase for the average retired worker that adds an extra $24 per month to their retirement check. Retired couples will see their combined benefits grow to $40 per month. This cost of living (COLA) increase is one of the smallest over the […]

World Trade: Is It Just Regulated Politics?

The World Trade Organization (WTO) is the only global international organization dealing with the rules of trade on a worldwide scale. It is a place for member countries to settle arguments and negotiate trade deals. But what happens when negotiations between two counties go awry, and tariffs continue to apply for long periods like we […]

Today’s Pre-Retirees: Financial Planning with a Contingency Plan

The demographics of retirement and a ‘retired person’ is rapidly changing worldwide. Over the past 200 years, there have been remarkable changes in health and wealth around the globe. Now, there is a converging demographic between countries, thanks to world aid and trade, and technology. Human life expectancy is increasing; in just the United States, […]

Is Lowering Interest Rates Good for the Economy and the Markets?

Interest rates can have a positive or a negative effect on the U.S. economy, the stock markets, and your investments. When The Fed changes the Federal Funds Rate (the rate at which banks can borrow money to lend to businesses or you), it creates a ripple effect. The raising and lowering of the Fed Funds […]

Net Worth is an Indicator of Financial Health: Companies and People

Consistent growth in net worth is an indicator of positive financial health, but when liabilities grow faster than assets, or the value of assets drop, the result is negative net worth. Net worth calculate by subtracting liabilities (owed debt) from assets owned. Net worth is estimated for both individuals and companies and is an accurate […]

What Does an Inverted Yield Curve Mean to Investors?

Due to the duration risk of holding assets over time, a normal yield curve shows that bonds with a longer maturity have a higher yield and pay more interest than short-term bonds. Investors usually demand higher rates of return if their money is invested for a more extended period. An inverted yield curve occurs when […]

The Human Side of Wealth Management

The financial services industry has classified “advice” as financial planning, not investment advice (the selection of investments), which is just one part of wealth management. If Robo-advisors have done nothing else, they have revealed that much of the investment advice in selecting investments can be automated. With technology doing much of the work as it […]

529 Savings Plans: For Education Expenses and Estate Planning?

A 529 plan is a state-sponsored tax-advantaged plan designed for saving for future education expenses that are authorized by Section 529 of the Internal Revenue Code. If used for education, the assets grow tax-free. Since 529 plans came into existence in 1996, they have grown to $328 billion in 31.1 million accounts according to Strategic Insight. There […]

Wealth Preservation: Portfolios Including Alternative Types of Investments

After the financial crisis, many Americans re-examined how and why they were investing. It was clear to many investors that having all of their wealth tied to the stock market proved to be more destructive than having alternative investments not correlated to stock market performance. This period was unfortunate if an investor needed to liquidate […]

Media Hype Exposure: Limit During a Recessionary Period

In light of recent media reports on stock market performance, political issues, scandals, and other ‘news-worthy stories,’ keeping yourself removed from media as much as possible may be right for you and your investments. Every day the American public is exposed to media stories that can negatively impact them and their investment decisions. During the last […]

Considering Buying a U.S. or Foreign Vacation Property? Be Tax Aware

With real estate prices recovering to where they were pre-2008 in most of the U.S; many people are buying U.S. vacation homes, and homes abroad for various reasons. The appeal of international vacation homes are at an all-time high as property overseas continues to cost less than near home, even in high-destination areas. A growing […]

Is Your Business Ready for Liquidation?

At some point, a successful business faces liquidation for all the right reasons. The business owner has built an asset that is now positioned to sell to another individual, a group of investors, or be acquired by a large corporation. Perhaps as the business has grown, planning has revolved around liquidating; however, often the liquidation […]

The SECURE Act: A New Hope for Retirement Savings

What is underway as one of the most significant changes to retirement savings plans in years, the SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019) was passed in May 2019 by the U.S. House of Representatives. The Act is awaiting approval by the U.S. Senate later this month (August 2019). If passed, […]

The Legitimate Value of Financial Advice

The financial advice industry has changed for advisors with a fiduciary financial planning emphasis in their practice. These advisors have chosen process over product for the benefit of their clients. Additionally, new regulations, technology-enabled efficiencies, and fee compressions will continue to influence the advice industry and ultimately lead to higher client satisfaction and asset growth […]

Are You Losing Sleep Over Money?

Why are more people feeling financial stress despite the strong economy we’ve experienced since the recession? Many Americans are losing sleep over money, according to a January 2019 survey by Bankrate. The media may report a ‘strong U.S. economy,’ but many people experience stress outside of what’s happening in the broader economy. The survey indicates that a large […]

Round Two of a Recession Amid Trade Wars?

As the economy shows signs of modest improvement, indications of downward shifting in U.S. production from the residual effects of the trade war are starting to surface, according to the May 2019 Federal Reserve’s Beige Book Report. The Beige Book Report compiles from information gathered by the twelve Federal Reserve Districts through direct interviews with businesses […]

Ensuring an Efficient Rollover of Your Retirement Savings Assets

The average American worker stays at a job only 4.2 years, and many had funded retirement accounts they’ve left with the employer’s plan custodian when they moved to a new job. Leaving retirement savings at multiple employers can create higher investment costs to keep the account in former employer plans or create an inconvenience to […]

Annuities and Market Risk: What You Need to Know

Market risk is something all investors worry about, but those close to retirement have limited time to recover from the loss. If you’re within ten years of retirement, your investments are at a critical stage to continue to gain value and avoid loss. Without thinking through the dynamics of gains and losses, investors leave themselves […]

Pre-Wedding $ Talks- Asset Protection and a Prenup?

Couple’s spend many hours planning and a significant amount of money on their wedding, but personal finances and protecting assets deserve just as much attention and planning. When both parties are in agreement on discussing their finances, reviewing credit reports, and asset and liability information, long term asset appreciation and protection should take priority before […]

Financial Interdependence: A New Way of Defining Adulthood?

Early adulthood is assumed to be a time of becoming financially independent. But an October 2018 study conducted by Agewave reveals that many adults ages 18-34 are not economically independent despite their adulthood. Many still rely on the financial support of their parents or extended family. The study reveals complex reasons leading to financial interdependence; something not […]

What Type of Annuity Is Best For Me?

Well, it depends … on when you want your payments, what kind of a guarantee you are looking for and whether you’re willing to take a little risk to pursue a possibly higher return. Breaking annuities down to their basics could help steer your decision. Full Kiplinger Article Here Authored by our very own, Richard […]

Social Security Retirement Benefits Funding: Time to Fix the Problem?

In the world of retirement planning, Social Security retirement benefits, referred to as Old Age and Survivors Insurance by the Social Security Administration (OASI), are still included as a source of income in retirement, but should it be? For those Americans that will retire after 2035, the future of receiving their projected full retirement monthly […]

Can Your Retirement Plan Pass a ‘Stress Test?’

In our working years, we work and save toward retiring someday, creating our retirement story. Our story may include daily golfing, living somewhere different, or participating in activities we enjoy each day that help to fill our minds with a picture of our retirement. But the plan of relocation and nonstop action should be stress tested to […]

2018 Was a Great Year for Fraud?

2018 was a record year for fraud in the U.S. and twenty-one other countries, according to Experian’s 2019 Global Identity and Fraud Report released earlier this year (February 2019). As the digital world advances, so does fraud. Today, digitization of services from banking to online shopping has made us more vulnerable to fraud, and more reluctant to […]

Tax Planning and Your Investments

‘Tax advice’ is left to federally authorized tax practitioners who prepare tax returns and defend clients pursuing relief from federal agencies for their own tax payments or to dispute tax payment errors. Financial advisors don’t provide tax advice, but provide information on the tax consequences of specific investments they sell or recommend to clients. This type […]

Planning for What Can Go Right (and Wrong)

Every financial client has their own story about what has happened in their life and what they hope to accomplish in the future. Life events can alter even the most carefully thought out plan. Some events clients experience are divorce, loss of a job, health issues, death of a loved one and longevity concerns when […]

Women and Retirement: Planning for the Retirement Savings Gap

As more boomers leave the workforce each day the future is uncertain for both genders when it comes to their retirement savings lasting their entire life. Many don’t know what to expect when it comes to rising health care costs, increasing living costs, and longer life expectancies. However, for women the retirement savings gap is […]

Inheriting an IRA? Here’s What You Need to Know

Inheriting from someone is a wonderful gift, but when it comes to securities assets, namely IRAs, different rules apply to non-spouse beneficiaries. IRS rules designate what the beneficiary can do with the IRA and how distributions must be taken. The laws on inherited IRAs depend on the relationship to the IRA owner and the type […]

Financial Planning After Losing a Spouse

Losing a spouse, whether through death or divorce, can be devastating emotionally and financially. The loss can take months or even years to recover since there is no way to prepare for death or divorce even when spouses have discussed contingencies with each other or with their advisor. When it comes to financial decisions some things need […]

Today’s Boomers: Ready for Retirement?

The ‘Boomer Generation,’ those born between 1946 and 1964, have a great outlook for a long life since they will outlive previous generations by almost 40%, compared to their great-grandparent’s generation. However, this generation faces circumstances that many of them didn’t plan for: Not saving enough to offset the disappearance of pension payments for their entire […]

Financial Literacy in America: We are Failing

“Financial literacy refers to the set of skills and knowledge that allows an individual to make informed and effective decisions through their understanding of finances. Education on the management of personal finances is an essential part of the planning and paying for post-secondary education.”- Webster’s Dictionary. Financial Literacy includes having a basic understanding of how to pay bills online, manage bank accounts, […]

Insuring for Your Level of Wealth

Insurance is not always an exciting topic to talk about, but financial planners are well aware of the risks their clients can face when they are underinsured. Whether it is homeowners insurance or life insurance, the different types of risks people face can easily wipe out a portfolio or other assets when their clients are […]

Financial Advice Before Turbulent Times

It is human nature to seek advice only when things aren’t going as planned or when some unforeseen situation arises. Take one’s health for example- some people routinely have an annual exam, while others seek medical advice only when they suspect a health problem and the symptoms have become severe. Just like seeking medical advice […]

Planning for the Long Haul: Is Your Plan for Retirement Bullet Proof?

The good news is we are living longer, but the bad news is that having regular employment, good health and the premature depletion of retirement assets is becoming a reality for many Americans. Despite plans for retiring later (compared to previous generations) at age 69 or into the 70’s, unplanned events are contributing to earlier […]

Are Early Retirement and Pension Buyout Offers a Good Deal for You?

In today’s economy, offers of an early retirement buyout for a current employee or a pension buyout directed at a former employee are becoming common as companies look for ways to cut costs. Many large employers are offering employees who are not yet at retirement age the option to take an early retirement buyout. Each company […]

GDP: Does It Affect Your Portfolio?

Gross Domestic Product (GDP) is the total of everything produced in a country, even if it is made by a foreign company or foreign workers within a country’s borders. GDP counts the final value of a product, but not the parts that go into producing it as a way to avoid ‘double counting.’ In many […]

Money Mistakes Parents Teach Their Children

Most parents want what is best for their children, but sometimes have habits themselves that equate to teaching their children poor financial habits. Children learn by watching their parents and other adults (modeling) and as they mature their mistakes and bad habits become hard to correct. Bad financial decisions can be especially detrimental when they […]

When Your Child Inherits

For many parents, planning to leave their estate to their children is a common practice. There are many things to consider when planning to leave your children an inheritance, but the complexity increases when your child is beneficiary to someone else’s estate. What happens when the minor child becomes an heir, or when the child’s […]

Looking Ahead: The Tax Cuts and Jobs Act and 2018 Income Tax Filing

This is the first tax filing season since the Tax Cuts and Jobs Act (The Act) was passed. Even though 2018 is over, there are tax planning strategies you should think about before you file and plan accordingly for 2019. There still remain 7 income tax brackets and the marginal rates have been lowered. However, many […]

Freezing Your Credit: What You Need to Know

A credit freeze is a way to protect yourself from a new account or loan being opened with your personal information by businesses (or criminals) without your permission. With a credit freeze the process of accessing your credit information from the credit reporting agencies is blocked. Freezing your credit at the three major credit reporting agencies is […]

The Perils and Possibilities of Self Employment

More people are choosing to become self-employed with one in three Americans leaving their jobs to go on their own. According to a twenty-year Harvard University Study republished in November 2018, the top reasons many are leaving stable employment is wanting more control over how and why they work and choosing who they work with for clients. […]

New Year, New Financial Resolutions?

The start of a New Year is the time when most people decide to implement changes in some areas of their lives. Whether it is health or money related, starting the New Year off with a plan feels good! According to research from YouGov Omnibus, last year 1 out of every 5 people (20% of the population) that […]

Financial Planning for a Couple’s Age Gap

Couples usually don’t retire at the same time when they have an ‘age gap’ between them. An age gap relationship is one where there is eleven or more year’s age difference between them. Age gap relationships are becoming more common as people are choosing to marry later in life, remarry or start a life-partnership with someone significantly […]

High Income, High Financial Planning Risk?

Despite having a high income from owning a business or being an executive, these individuals can experience retirement savings problems. They have missed savings opportunities or put off financial planning. Often they assume that everything will work out with their retirement plan, and it can, but their high-income can hide the reality of a retirement […]

Long Term Care Planning in My Retirement Planning? Yes, Here’s Why

Regardless if you believe in Long Term Care (LTC) insurance or not (or your advisor doesn’t) you still need to include the costs related to LTC in your retirement plan, even if you’re able to self-pay. Why? Because the statistics on longevity show that people are living longer and will likely need LTC at some […]

Safeguarding Your Personal Information Online and Offline

Here in the U.S., our personal information is exposed daily at frequencies and levels we’ve not experienced before. It doesn’t take a data breach from a technology company to expose us, we are doing it to ourselves without being aware. Each time we use technology (Facebook, Instagram, online exposure) our personal information is gathered by […]

Qualified Longevity Annuity Contracts: Making Your $ Last for Life

Among the primary concerns people have as they approach retirement is, “How long will I live and will my money last?” In addition to traditional retirement savings such as employer-sponsored retirement plans, there’s now another type of retirement account that guarantees you won’t go broke during retirement. Qualified Longevity Annuity Contracts (QLACs) allow you to […]

New IRS Changes for Retirement Plans in 2019

The IRS announced last month in November cost-of-living adjustments to limits on contributions to retirement plans for 2019. There hasn’t been an increase in some plan types since 2013, which is why now is a great time to take advantage of maximizing retirement contributions. According to a 2017 FINRA study,10% of American retirement savers are contributing […]

Continuing Ed: Helping Create Quality Financial Advisors

Continuing education helps financial advisors stay informed of the latest industry and regulation changes while educating them on products and solutions to help their clients. Taking continuing education classes helps them become better at their job, too! Providing quality service by having the product knowledge to present the right solution while following state laws and […]

Your ‘To-Do’ List: Schedule a Fall Financial Review

Scheduling a fall financial review is especially important this year due to the Tax and Jobs Act and impending market changes. We’ve been enjoying a robust stock market which makes now a prime time to meet. Fall tends to be when people start thinking about next year and what they want to accomplish financially by […]

College Planning Isn’t Just About 529 Plans

There is a growing trend in college planning where families hire an Independent Education Counselor (IEC) to help plan, execute strategies for the ACT or SAT testing and assist in applying to college in hopes of being accepted. IECs start working with families as early as the eighth grade if the family is considering an […]

Do You Understand Your Employee Benefits?

As we approach the end of 2018 many employers are scheduling their benefits meeting requiring you to select yours before the end of the year. Not all benefit options are the same and understanding each is crucial to making an informed decision. Ask your HR department or the advisor or agent representing the benefit what […]

5 Questions Answered: Social Security Retirement Benefits

How is my social security calculated? Social Security is calculated using your 35 highest paid earnings years and then averaged using the benefits calculation formula. You must have worked full time for at least 10 years to qualify for any social security retirement benefit. Currently, full retirement benefits age is between age 66 and 67 (October 2018). […]

Happy Retirement, LIBOR

There’s a number that is going away soon that has an impact on your life; it’s called LIBOR. LIBOR (London Interbank Offered Rate) is used to determine the interest rates banks charge each other for overnight, one-month, three-month, six-month, and one-year loans. LIBOR is a substantial number because it decides, in part, the interest rate you will pay for […]

Calling All Investor Types

Some investors are the do it yourself type and manage their accounts with minimal assistance from a financial advisor. Other people are eager to have an advisor manage their investments for them. Whatever type of investor you are, no single investor knows everything about the stock market. Even from time to time, knowledgeable investors ask […]

Tariffs and Trade Wars: The Impact into Q3

After months of verbal threats between the EU, China and the US, tariffs, and counter-tariffs started in July 2018, leaving American consumers and investors wondering how much of an impact it will have on them. Already three months into the trade war, consumers are not swaying from buying imports despite the increasing costs. In July, the US […]

The Great Wealth Transfer

Over the next twenty years, there will be a wealth transfer that exceeds $30 trillion as the Baby Boomer generation passes the remainder of their wealth to the Millennials and subsequent generations. The Baby Boomers (born 1946-1964) are considered the wealthiest generation, currently controlling 70% of all the disposable income in the United States. Its imperative […]

End of Year Money Moves

It’s that time of year again; kids go back to school, the election season is near, fall holiday planning starts, and suddenly we all move closer to the end of 2018. As we approach the last quarter of the year, remember these ‘money moves’ that you still have time to make: Checklist of Money Movement Add […]

Estate Plans and Wills: Not Just for Retirees

Regardless of your age, having a will or estate plan is essential for many reasons, and isn’t just limited to passing assets at death. A will provides necessary asset passing, although many times isn’t enough when situations become more complicated. Although estate plans and wills typically become active at death, they can be helpful during catastrophic […]

Why it ‘Pays to Be Nice’ When Divorcing

Divorce is a common occurrence in the US, with 50% of all first marriages ending in divorce. According to the American Psychological Society, that is even higher for those marrying a second time. Marriages end for many reasons from infidelity, stress, personality changes, and financial. They are not only devastating to the children and extended family but […]

Donor-Advised Funds: A Solution to Itemized Deductions Loss While ‘Doing Good’

For families who previously used itemized deductions for charitable giving when filing their taxes, The Tax Cuts and Jobs Act (TCJA) will remove this benefit, resulting in default to the standard deduction for their 2018 filing. This effects a household choosing to use charitable giving as a tax deduction, increasing the tax cost to them by 7%. The […]

The Value of Planning for Life’s Messes

Planning is valuable for many reasons and helps to ‘normalize’ things when you find yourself in the middle of an unexpected life event. A death, a critical illness, job loss, new family member, an inheritance, divorce, or a catastrophic event that can cause a major financial detour. How you plan will help determine how you survive and […]

Social Security Retirement Benefits: Why Waiting May Be the Best Decision

Taking Social Security Benefits can be a guessing game unless you do your research to figure out what age to take benefits the best for you. Do you receive benefits at the earliest age or wait until your full benefit age? Will you die in early retirement or live a longer life than you imagined? These are the […]

Fiduciary Financial Advice

One thing that has plagued the financial services industry is ‘trust’ of the industry. Unfortunately, there are many reasons that some people have developed a distrust of financial companies and the individuals that work for them. It may be due to the media, entertainment (movies), or a personal situation that has happened in the past. When advisors work […]

Why the Technology (and Person) Managing Your Money Matters

Money and technology are so closely related that if a financial advisor isn’t employing the latest technology, how will it equate to risk for you and your money? When it comes to managing your money, you expect your financial advisor to have the best technology resources available to do the job. Since the last recession, the financial […]

The New Senior Safe Act: S$A Provides Immunity for Reporting

On May 24th, 2018 President Trump signed The New Senior Safe Act into federal law, encouraging financial professionals to report senior financial abuse. Since financial advisors and bank employees are usually the first to witness clients making money withdraws that are not common, the law rewrites protocol and protection for those that report abuse. The old law […]

Understanding Credit Utilization and Its Impact on Credit Scoring

Credit scores are used in our country as a method to determine an individual’s financial responsibility. The three-digit credit score means more than just the possibility of fiscal responsibility to the lender. They are part of a formula called credit utilization. Understanding how your ‘number’ fluctuates regardless of making payments on time, can help you get more from your […]

Questions Every Investor Should Ask Their Advisor

Many investors evaluate not only their portfolio performance but also their relationship with their financial advisor from time to time. Many times people base their evaluation of their advisor on their portfolio performance, but there are other components to consider. Asking these questions can help you determine if you and your advisor are mutually aligned: Question #1: Are you […]

Financial Literacy: The Best Strategy for Preserving Wealth

How did you learn to manage money and understand the value of investing? Did your parents relay to you what they knew about money or did you read books on budgeting and investing in figuring it out yourself? The reality is that many of us did learn through trial and error. An alarming statistic is […]

Suitable Investments and You

suit·a·bil·i·ty: The quality of being right or appropriate for a particular person, purpose, or situation. The definition of suitability seems quite easy to understand and should be clear when it comes to investment recommendations to clients. However, many times when clients come to our firm the investments they have are not suitable for them. We base this conclusion […]

The Second Half of Life- Discovering Your Passion

At some point along your life’s journey, you might find yourself at a crossroads looking back thinking, “Is this it? Is this all there is to life?” while considering the path ahead of you. It can happen at any time- you’ve spent your life building something that has taken all your blood, sweat, and tears and you […]

Positive Impacts of the Financial Crisis

The financial services industry is still recovering from the effects of the financial crisis. Positive impacts from the crisis include new regulations and clients taking an increasingly active role in their economic destiny. Reinforcing this is that all participants—financial advisors, clients, and regulators—are all welcoming the greater transparency and convenience that new financial technology (FinTech) is bringing to the […]

Tariffs, Trade Wars, and Your Investments

Since President Trump announced his intention to impose tariffs on all countries the stock market has been reacting-based on investor concerns in reaction to the media. All indications at the time of this writing are that the tariffs would be applied to all countries, although that remains unknown. This development has risen the speculation of a trade […]

Personal Training Advice Style

For those of you that have ever hired a personal trainer–you know what that experience is all about. The first day is the one that you will never forget because it was hard both physically and mentally. You probably found out that you weren’t as strong as you thought you were or maybe that you didn’t prepare […]

7 Common Ways to Mishandle Your Inheritance and Waste Thousands of Dollars

Receiving a large sum of money through an inheritance or other windfall can be stressful, exciting, and confusing all at once. Managing a large sum of cash can seem overwhelming, particularly if it’s an experience you’ve never had before. Here are seven common inheritance mistakes and how you can best avoid them. Follow these tips […]

Privacy, Social Media and You

In April 2018 Facebook’s CEO, Mark Zuckerberg’s admittance of Facebook user’s data used by Cambridge Analytica in our last presidential election has caused an emotional reaction in Americans and lawmakers alike. Zuckerberg admitted that controls to prevent such a leak were not in place and that, he too, believes social media will need to be regulated […]

Is Early Retirement a Reality?

We all desire the flexible lifestyle, to not work or work when we want. Wouldn’t it be great to spend more of our lives not working than working? There have been countless financial plans created with this target in mind, but it may not be a reality to stop one’s career before reaching the […]

The Inflation Factor

Despite the fallout to investor’s portfolios, job losses, and the overall downward turn of the American economy during the recession, we have benefitted from relatively low inflation rates. While the US and other countries control monetary policy, there is never a way to avoid inflation after a recession; it’s part of the economic cycle. Borrowing and buying […]

The Cost of Credit

2017 was a bad year for the credit industry- data breaches and multiple lawsuits. But it’s becoming apparent that Americans overall are going to have a worse 2018 compared to last year as the trend of acquiring more debt increases. Aside from having to shell out money for damages caused in 2017, the credit industry will have […]

Reasons Why You Should Definitely Consider A Company 401(k) Plan, Even If You’re A Small Business

The ability for a business to offer a 401(k) plan is often seen as the benchmark of a large, successful company. Organizations with retirement benefits have been shown to attract better talent, while roughly a quarter of small businesses say that employees who leave for another company cite a lack of these benefits as a […]

Planning for The New Tax Plan

Many Americans have already filed their taxes for 2017, but the majority will be filing this month and finding out how the new tax plan is impacting them (if at all) for this spring’s filing. Some changes have already taken place such as the adjusted withholding in February’s paychecks resulting in slightly higher take-home pay. However, the […]

Let’s Talk Robo

Have you seen the TV commercials about a machine or robot as your investment advisor? As funny as they may be, they may be giving you the wrong idea of what a robo-advisor really is. A robo-advisor is technology (an automation platform) that allows automation for certain aspects of portfolio management. One of the misnomers in the industry […]

When The Stock Market Corrects

If you’ve been sensitive to the stock market performance in the last weeks, you’re not alone. Regardless of how your investments fare during market corrections, being aware of your anxiety in light of what you’re seeing, reading or hearing can make a difference in portfolio performance. We’ve all done it; reacted either internally or externally […]

The Extinction of Pension Plans: Is a Buyout Right for You?

If you’re an employee working for a company that has a pension plan, you’re among an estimated 4% of Americans that still benefit from this type of retirement plan. Most companies have moved to a dual plan or removed the pension entirely. Traditional government workers are among the few who benefit from pension plans. The likelihood […]

Legacy Planning as Part of Life Planning

Leaving a legacy through the passing assets today and after your death is a process that requires correct planning and execution. With the recent Tax Cuts and Job Act of 2017, updated tax codes, and an ever-changing political environment, legacy planning requires consulting with multiple professionals in order to pass assets without financial consequences. Legacy planning […]

Tax Season (aka Scam Season) is Here

With the significant 2017 cybersecurity leaks involving the personal information of millions of Americans, this year’s tax season is expected to be one of the worst ever for tax scams. Aside from cybersecurity leaks, the mailing of 1099s and W2s results in many people not receiving them through mailbox theft, which is contributing to more […]

Fear, Greed, and Your Portfolio

Finance, in general, has been based on rational and logical theories, and for most part, tends to be somewhat ‘predictable.’ Early financial theories assumed that people behave rationally and predictably, and that outside factors and emotions do not influence people when it comes to making financial decisions. However, behavioral finance has proven people behave irrationally […]

Is Retirement Really About Numbers?

For some people retirement is all about the numbers; the age you plan to retire, how much money you need, and so forth. We have built our planning processes in financial services based on numbers and algorithms in financial planning software to help us contrive a number or group of numbers that are uniquely yours. […]

Bitcoin, Cannabis, and Other Alternative Investments – Las Vegas, NV

If you’re considering alternative investments this year, you should thoroughly think through the consequences of investing in some of the most popular ones in the media. Although Bitcoin and the Cannabis business may be on Wall Street’s radar, it’s not necessarily for good reasons. Both are still considered speculative and are not investable asset classes; they […]

Be More Money Savvy in 2018 While Saving for Retirement

A Quick Guide to Saving in 2018 Start Saving More NOW! If you started saving for retirement early, chances are you’ll hit your retirement goal. If you’re like most Americans, you didn’t start right away and are playing ‘catch-up’! Don’t put off saving later, start now! If you didn’t start in your 20s, it’s time […]

4 Must-Know Components to Successful Retirement and Healthy Aging

With a one in five chance of living beyond our 90th birthday, planning for a successful retirement and healthy aging should be something we all do. Retirement is now considered a time to be active where people stay socially connected, continue working in some capacity, and are choosing to be involved in their communities. Retirement today […]

The New Tax Plan and You

If you’re like some Americans, you may be wondering how the new tax plan is going to affect you. To say “the new tax plan isn’t going to affect me” may be an incorrect statement; sooner or later the new plan will change something in your financial life. It doesn’t matter if you’re on ‘one […]

Filial Laws: Avoid a Financial Crisis for Your Family

If you’re not familiar with Filial Laws, it’s time you take notice of what they are and how these laws can impact your financial future. A few decades ago, our US welfare system would cover nursing home and medical costs for someone without the financial resources to so. Back then the children were ‘off the […]

New Year, New Plan